What is the process of selling your home to OpenDoor here in Atlanta, GA? We are here to answer your questions! Opendoor is a technology company that transacts in residential real estate. Based in San Francisco, the company makes instant cash offers on their website through an online process and makes any necessary repairs to these properties before putting them back on the market for a potential profit. Yes, they are corporate house flippers. But how is Opendoor different from other iBuyers like Zillow, for example? They’re not; not really. In this article we will discuss the potential upside and/or downside of selling your Atlanta home to the iBuyer Opendoor.

What is the process that Opendoor uses to buy an Atlanta home?

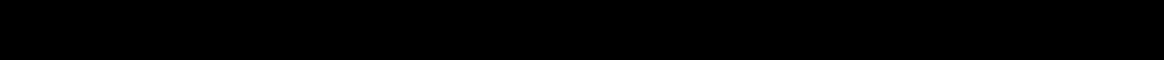

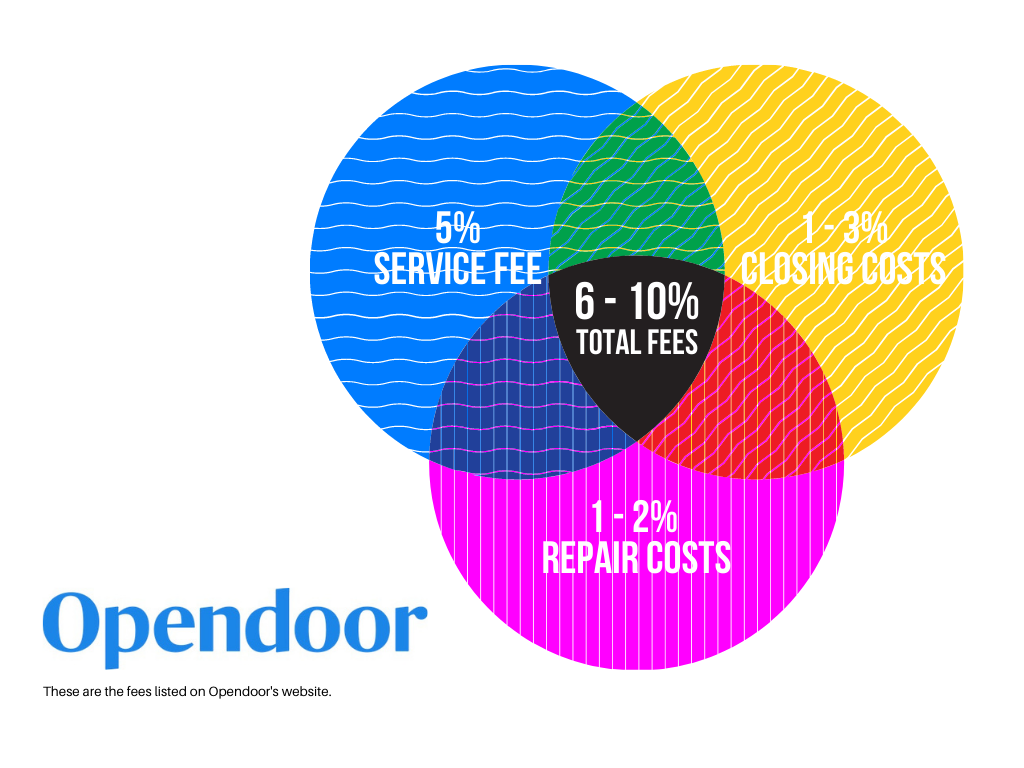

From what we can observe, Opendoor prospects for potential homes to buy primarily by using pay-per-click (PPC) advertising. Since the market has gotten tighter on inventory, they also rely on direct mail and television commercials to advertise their platform. Their advertisement encourages potential home sellers to visit their website to request an offer. The offer is free to receive and if your home meets their criteria, discussed below, you will receive a “competitive” offer and have 5 days to think it over. You can close anywhere from 14 to 60 days after you go under contract depending on when you would like to move. The offer that you will receive has a breakdown of the value of your home, based on an automated valuation model, their transaction fee and the closing costs they estimate that you will pay. What makes an Opendoor offer for your Atlanta home competitive? According to their website, you will save on potential staging fees, seller concessions, and the cost of living you will maintain by living in your home from the time that you go under contract to the time that you close. Here is a breakdown of their model Opendoor vs. Traditional: Opendoor predicts that a home seller who sells their home to Opendoor with an offer price of $200,000 will net $8,000 more than in a traditional sale. Let’s break this down because there are so many issues here. Seller FeesFirst of all, the “seller fees” they have listed are not called seller fees in a traditional sale. They are referring to real estate commissions and like in all other aspects of real estate, the amount of commission that you will pay is negotiable. Talk to your Realtor about your financial goals and what they will do in order for you to meet those goals. Your Realtor should be able to outline how they will be able to help meet your goals and make their commission pay for itself. When Opendoor says “seller fees” they are referring to the cost that they are passing off to you for the “convenience” of selling your home to them. They say that their fee will not be higher than 5% but is subject to change. It covers the cost of buying your home, maintaining your home and eventually selling your home to another buyer. No matter how you look at it, you are going to have to pay someone to sell your Atlanta home whether to a traditional buyer or to an iBuyer like Opendoor. Staging and Home Prep CostsOpendoor notes that there is no cost to prep your home to receive an offer from them but if you think that you will receive the best offer possible by not preparing for the home assessment that comes along with your offer then think again. It benefits you to spend a small amount of time and money in preparing your home for sale. Whether it be a fresh coat of paint or replacing your carpet, the less work the new buyer has to do, whether they are an iBuyer or a traditional buyer, the better off your net proceeds will be at closing. Now will it cost 1% of your home's value to stage and prepare your home? That depends on the state of your home. If you have allowed things to fall by the wayside and have not maintained your home then chances are you may need to pay more to make your home presentable. When it comes to home staging, no one is staging homes right now unless it’s a multi-million dollar vacant piece of property. Your home will likely be on the market for less than a week with how the Atlanta market is trending these days. Instead of staging, start to clean and declutter your home. What can be boxed up? How can you show how much cabinet space you truly have? What about some of the things that you know you won’t take with you, get rid of them now. You don’t have to stage your home like what’s in Southern Living Magazine in order to sell it. Clean up, declutter, make presentable, period. Repair Costs: Depend on AssessmentWhat Opendoor is saying is that in order for them to buy your Atlanta home from you, they will come in and tell you exactly what is wrong with your home and how much it will cost them to make the repairs before they can sell it back to another buyer. Something that is truly not your problem. According to Opendoor, the purpose of the free in-home assessment is to verify the data that you entered on your request for an offer and identify any potential repair costs. If there are any repairs, and let’s face it, if your home is more than 10 years old then the likelihood of them finding something wrong with your home is high. Opendoor will then ask you for a seller credit or what us professionals call a “seller concession” in order to compensate them for the repairs that they will make. Opendoor notes that this helps you; that you won’t have to deal with the headache of making repairs yourself but let’s be honest here, you don’t have to do anything. You don’t have to make repairs; you can either do them or not. You can negotiate your way out of this issue as well. Would you rather pay Opendoor’s third party contractors to make repairs to your home or would you rather find someone who can make repairs as needed for a potential savings? Your Realtor should have a database of contractors that he or she can call if you need assistance with cost-effective home repairs. How will you know if repairs are needed? You can start by taking a look around your home. Anything jump out at you? No, great, get the house on the market. When the home goes under contract, and the buyer gets the home inspected, they may ask for reasonable repairs or concessions. Because we are in a seller’s market, you can decline to make any repairs or choose to make repairs that will prohibit your buyer from obtaining financing. What do we mean by this? When buyers get FHA loans, the FHA lender wants to make sure that the buyer will be able to move in on the same day that they close on your home. Because of this, if there are any issues with any of the systems in your home (plumbing, electrical, HVAC) then they will want these items to be repaired. Do yourself a favor and get a home warranty. It is cost effective and if something comes up during the inspection for one of these systems, your home warranty will pay for them minus a small deductible. At Woodland Realty, we provide all of our sellers with free home warranties while their homes are listed on the market. If anything happens to your home while it is listed, the home warranty will take care of the repairs. Homeownership & Overlap CostsIn our opinion, they are grasping at straws with this one. Of course you will have to pay to stay. Of course you will have to maintain the cost to live somewhere while you are selling your home. The new buyer of your home also has the same costs, so does your Agent, your grandmother and every other living person. Closing CostsUnfortunately, there’s no escaping closing costs no matter who you sell to. Common closing costs paid by the seller are:

Opendoor predicts that a home seller who sells their home to Opendoor with an offer price of $200,000 will net $8,000 more than in a traditional sale. Let’s break this down because there are so many issues here. Seller FeesFirst of all, the “seller fees” they have listed are not called seller fees in a traditional sale. They are referring to real estate commissions and like in all other aspects of real estate, the amount of commission that you will pay is negotiable. Talk to your Realtor about your financial goals and what they will do in order for you to meet those goals. Your Realtor should be able to outline how they will be able to help meet your goals and make their commission pay for itself. When Opendoor says “seller fees” they are referring to the cost that they are passing off to you for the “convenience” of selling your home to them. They say that their fee will not be higher than 5% but is subject to change. It covers the cost of buying your home, maintaining your home and eventually selling your home to another buyer. No matter how you look at it, you are going to have to pay someone to sell your Atlanta home whether to a traditional buyer or to an iBuyer like Opendoor. Staging and Home Prep CostsOpendoor notes that there is no cost to prep your home to receive an offer from them but if you think that you will receive the best offer possible by not preparing for the home assessment that comes along with your offer then think again. It benefits you to spend a small amount of time and money in preparing your home for sale. Whether it be a fresh coat of paint or replacing your carpet, the less work the new buyer has to do, whether they are an iBuyer or a traditional buyer, the better off your net proceeds will be at closing. Now will it cost 1% of your home's value to stage and prepare your home? That depends on the state of your home. If you have allowed things to fall by the wayside and have not maintained your home then chances are you may need to pay more to make your home presentable. When it comes to home staging, no one is staging homes right now unless it’s a multi-million dollar vacant piece of property. Your home will likely be on the market for less than a week with how the Atlanta market is trending these days. Instead of staging, start to clean and declutter your home. What can be boxed up? How can you show how much cabinet space you truly have? What about some of the things that you know you won’t take with you, get rid of them now. You don’t have to stage your home like what’s in Southern Living Magazine in order to sell it. Clean up, declutter, make presentable, period. Repair Costs: Depend on AssessmentWhat Opendoor is saying is that in order for them to buy your Atlanta home from you, they will come in and tell you exactly what is wrong with your home and how much it will cost them to make the repairs before they can sell it back to another buyer. Something that is truly not your problem. According to Opendoor, the purpose of the free in-home assessment is to verify the data that you entered on your request for an offer and identify any potential repair costs. If there are any repairs, and let’s face it, if your home is more than 10 years old then the likelihood of them finding something wrong with your home is high. Opendoor will then ask you for a seller credit or what us professionals call a “seller concession” in order to compensate them for the repairs that they will make. Opendoor notes that this helps you; that you won’t have to deal with the headache of making repairs yourself but let’s be honest here, you don’t have to do anything. You don’t have to make repairs; you can either do them or not. You can negotiate your way out of this issue as well. Would you rather pay Opendoor’s third party contractors to make repairs to your home or would you rather find someone who can make repairs as needed for a potential savings? Your Realtor should have a database of contractors that he or she can call if you need assistance with cost-effective home repairs. How will you know if repairs are needed? You can start by taking a look around your home. Anything jump out at you? No, great, get the house on the market. When the home goes under contract, and the buyer gets the home inspected, they may ask for reasonable repairs or concessions. Because we are in a seller’s market, you can decline to make any repairs or choose to make repairs that will prohibit your buyer from obtaining financing. What do we mean by this? When buyers get FHA loans, the FHA lender wants to make sure that the buyer will be able to move in on the same day that they close on your home. Because of this, if there are any issues with any of the systems in your home (plumbing, electrical, HVAC) then they will want these items to be repaired. Do yourself a favor and get a home warranty. It is cost effective and if something comes up during the inspection for one of these systems, your home warranty will pay for them minus a small deductible. At Woodland Realty, we provide all of our sellers with free home warranties while their homes are listed on the market. If anything happens to your home while it is listed, the home warranty will take care of the repairs. Homeownership & Overlap CostsIn our opinion, they are grasping at straws with this one. Of course you will have to pay to stay. Of course you will have to maintain the cost to live somewhere while you are selling your home. The new buyer of your home also has the same costs, so does your Agent, your grandmother and every other living person. Closing CostsUnfortunately, there’s no escaping closing costs no matter who you sell to. Common closing costs paid by the seller are:

- Property taxes: Depending on what time of the year you sell your home, you may get a credit or a debit for property taxes. This cannot be avoided.

- Liens: If you live in the City of Atlanta chances are you may have a water bill lien out there that you had no idea about. This is something that would be paid at closing.

- Fees paid to your lender: Your lender may charge you for a payoff letter or to pay to release your mortgage lien from the property.

- Cost to wire funds: Let’s face it, no one wants to wait around for a check to clear. Pay the closing attorney to wire the funds to you. The monies will be available the same day within an hour of the transfer.

- Past due HOA fees or assessments: You will have to pay these at closing. Similar to property taxes, you will pay off your remaining balance up until the day that you close.

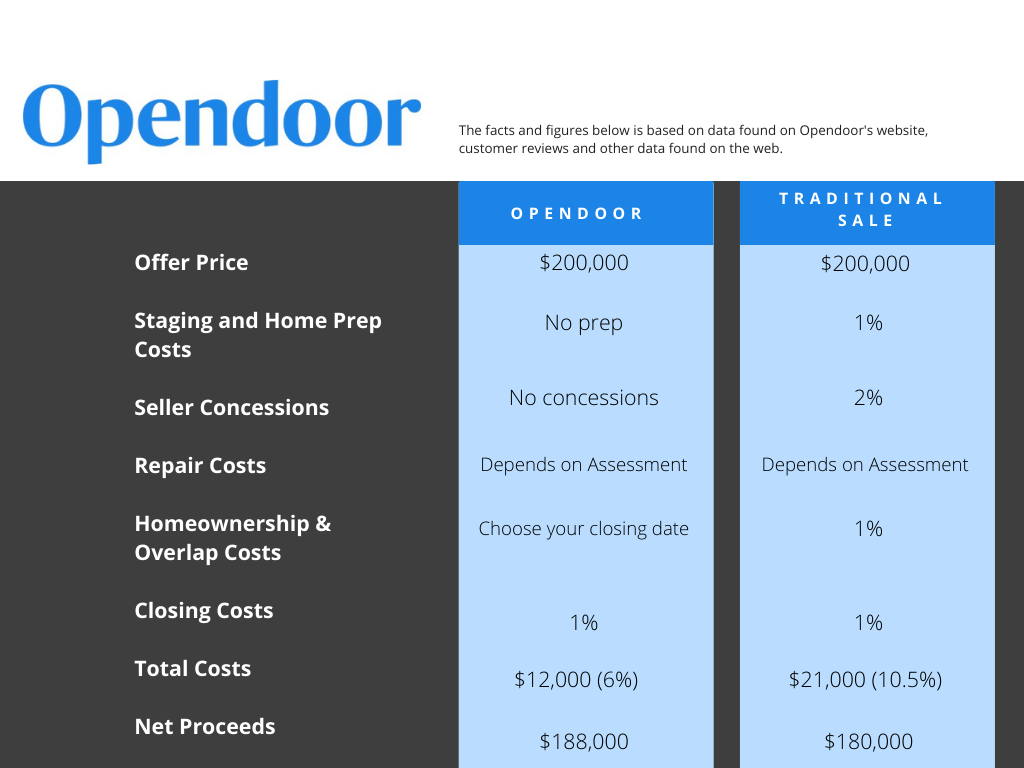

These are the infamous closing costs and they generally are less than 1% of the total sales price. There’s no way to put a percentage on this number since the sales price of your property generally doesn’t line up with the tax assessor’s valuation therefore we are not able to assume a percentage of the sales price for closing costs. So What Does Working With Opendoor Actually Cost Atlanta Home Sellers?While you will pay less fees with Opendoor than you would pay with Zillow, for example, you will still be paying a higher amount of costs than you would in a traditional sale. Here’s the breakdown according to this website: On average, home sellers will pay between 6% to 10% to sell their home to Opendoor.

On average, home sellers will pay between 6% to 10% to sell their home to Opendoor.

Other Opendoor Service Offerings

List with OpendoorUnlike Zillow, Opendoor encourages you to list your home with Opendoor. Per their website, you will pay 1% less than if you would list your home with a traditional real estate brokerage at a 5% commission and you could potentially net $5,000 or more dollars in listing it with Opendoor than by selling it to Opendoor. Is this really a savings? What does Opendoor do differently when listing than what a traditional real estate brokerage can provide? Will you get individualized attention, a custom marketing plan, work with people who actually know your community or will you work with a corporation based in San Francisco who knows nothing about the local Atlanta market? Opendoor Trade-inWhen both buying and selling a home with Opendoor, the customer gets a 1.25% rebate of the sales price of their first home paid out as cash or as a credit towards the closing costs of their new Opendoor home. What type of Atlanta Homes Does Opendoor Buy?Like other iBuyers, Opendoor has a list of criteria that they follow in order to buy homes that will keep their investors happy at the end of the day. These home types include:

| Home Types |

Single Family Homes Townhomes Duplexes in certain markets Condos in certain markets

|

| Opendoor Valuation |

They try to buy homes valued between $100k-600k depending on the market |

| Max Acreage |

They won't buy a home on more than 2 ac of land. The lower the number, the better due to the costs to maintain the property while they own it. |

| Year Built |

They buy homes built after 1930 but prefer newer homes |

| Ownership & Occupancy |

They will only buy owner occupied homes with clear titles. (No, they don't want to deal with your tenants either, lol) |

| Solar Panel |

They will buy a home with a panel if the panel is owned by the seller outright or is paid off before or at closing. |

| Other criteria that may impact their purchase decision: |

|

Pros and Cons to Selling Your Atlanta Home to Opendoor

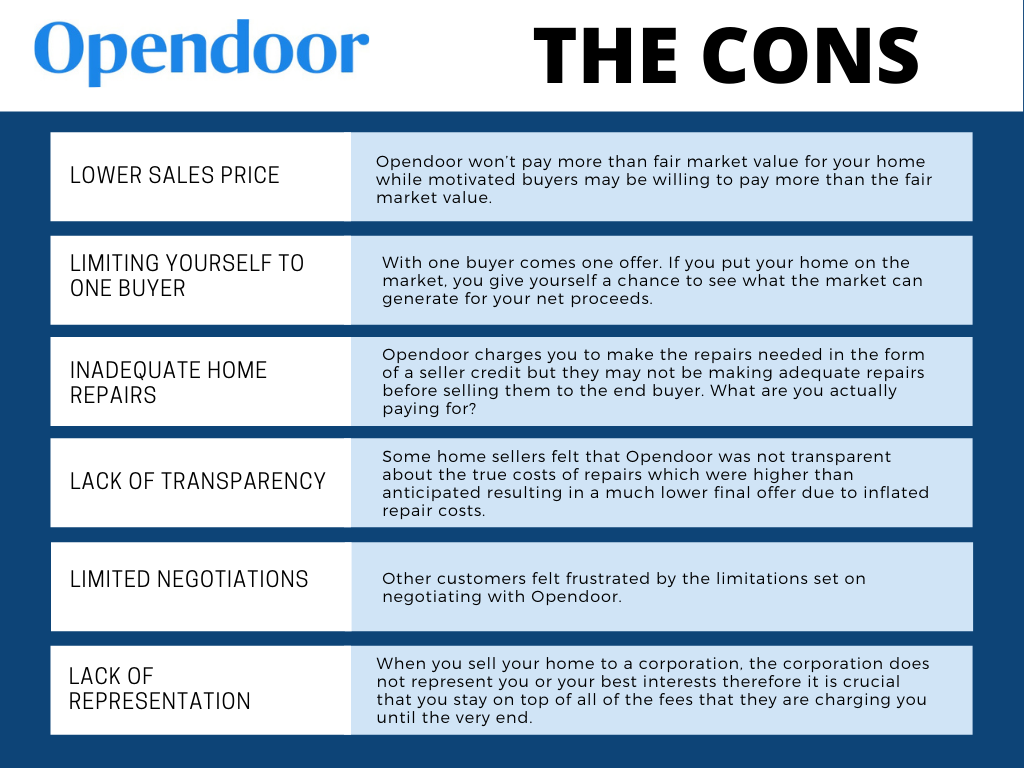

Critics are especially harsh on Opendoor stating that the company preys on people who are in a financial pickle, who need quick cash and who don’t have enough of an understanding of the numbers related to their home sale.

Critics also speculate that the service fee that you are charged, while 1% lower than traditional real estate commission, only works out if you get the best price for your home. On average, Opendoor offers come in $10,000 or more under market value. Opendoor uses a series of algorithms optimized to maximize their own profit margins. With all this being said, selling your home to Opendoor in a seller’s market may not be your best bet.

Lastly, critics state that the only value proposition that Opendoor seems to be selling is the convenience sellers experience when selling their homes to the company but what do you think?

Based on what you’ve read here, would you consider selling your Georgia home to an iBuyer like Opendoor?

We’d like to hear from you.

Click here to read OfferPad: A Better Way to Sell Your Home?